Today I share with you bullet journal budget layouts that’ll help you to get your money under control and manage it like a girl boss (with millions on her account).

Also, you’ll get free bullet journal printables for budgeting.

In fact, this bullet journal setup for personal finance helped me to cut off my monthly expenses by a third, start saving more money and eventually quit my corporate job to become a full-time blogger.

So if you want to know:

- what is a money journal

- how to organize your finances with a bullet journal and keep up with it

- how to set up bullet journal budget layouts in order to master your money

Then keep reading.

Also, you can download your free bullet journal budget trackers, including the following financial printables:

- budget tracker

- income tracker

- bullet journal expense tracker

- savings habit tracker

- bill planner printable

- bullet journal credit card tracker

Table of Contents

Disclosure: I’m not a financial advisor. All opinions presented in this blog post are based on my personal experience. You’re the only one who is responsible for any financial decisions.

This post may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. It means that I may receive a commission if you click a link and purchase a product that I have recommended. It won’t cost you any extra money.

What is a Money Journal

Similar to a bullet journal, a money journal can help you improve your finances.

Creating bullet journal spreads like bills tracker, expense log, savings tracker, budgeting log, and debt payoff tracker allows you to:

- express how you feel about money by journaling

- set financial goals to live your life with no debts and be financially independent

- plan your expenses ahead aka budgeting and control your financial health

- organize your finances

- track your financial habits

- start saving and get creative with your money

How Do You Keep up with Financial Journals

At first, when you start a new project like a financial journal, you’re motivated and excited.

However, after a while, you may feel discouraged and you’re close to giving it up.

If you’re wondering how to keep up with the financial bullet journal, I’ve got some genius tips and tricks for you.

First and foremost, it’s ok to get inspired with amazing finance bujo spreads, but don’t copy them.

Undoubtedly, you’re a totally different person with a different lifestyle, needs, goals, etc.

For that reason what works for me, may not work for you.

So it’s important to adapt bullet journal spreads to personal preferences.

Secondly, setting up bullet journal budget layouts within your everyday notebook makes you more likely to fill your budget layouts out with consistency.

Moreover, it’s easier to create financial journaling as a habit within your monthly or weekly habit tracker.

Thirdly, use the right tools.

Obviously, you may create budgeting spreads on a regular piece of paper but let’s face it: we all love good quality bullet journal supplies.

Last but not least, keep your bullet journal handy.

Again, it’s more likely you will use it on a regular basis.

How to Organize Your Finances with a Bullet Journal Budget Layouts

If you want to master your money with a bullet journal, you may want to start with the following steps:

- develop a healthy relationship with money and get rid of any money blocks with bullet journal money mindset spreads like personal finance education tracker, quote page, bullet journal vision board, money affirmations page, and gratitude log

- write down your financial goals and create a money rule on the next two pages

- track your expenses with a spending log

- improve your money management skills with bullet journal budget layouts for budgeting

- track your savings goals with a savings tracker

- follow your debt payoff progress with a debt payoff tracker

Bullet Journal Money Mindset Spreads ((Bullet Journal Budget Layouts)

In most cases, your money beliefs probably hold you back from financial success.

While growing up, you often hear some common sayings from your parents like money doesn’t grow on trees, the best things in life are free or you can’t take it with you.

And while it’s all true, it influenced your money mindset in a negative way.

Now, you may be thinking that money causes stress, rich people are greedy, and you don’t care about them.

Moreover, you’re constantly struggling with money in your life.

You always say that you don’t have any money, I can’t afford it, it’s too expensive, etc.

Apparently, nowadays it’s trendy to be financially unstable.

Generally, money is a taboo topic.

When it comes to talking about money, some of us get a nervous giggle, become uncomfortable, and even stressed out.

From my perspective, I used to have a love-hate relationship with money.

On one hand, I’ve always been a frugal person and lean toward minimalism.

On the other hand, I didn’t think a lot about my personal finances, retirement, or investing.

I had this scary, poor-money mindset that more money equals more problems.

After investing in personal finance education, I’m on a good path to overcoming my money blocks.

Obviously, bullet journaling doesn’t make it happen, that you switch your money mindset.

But creating some bullet journal spreads like a personal finance book tracker, quote page, vision board, money affirmations page, and gratitude log will help you tremendously to detox your mindset, breakthrough your money blocks, and improve your relationship with money.

Bullet Journal Personal Finance Education Tracker

Definitely, changing your money mindset requires time.

In order to learn from scratch how to manage your money and build a good relationship with it, spending your time on personal finance education is a must.

Because of that, bullet journal spreads like a reading log or podcast tracker will help you to track your study progress with ease.

Bullet Journal Quote Page

Undoubtedly, studying inspirational money quotes helps you with your financial mindset shifting.

For that reason, I decided to put together a list of my favorite money quotes you can choose from to put on your bullet journal quote page.

Money grows on the tree of persistance

Money may not buy a happiness, but I’d rather cry in a jaguar than on a bus

It’s not a good deal if you don’t need it

Personal finance is only 20% head knowledge. It’s 80% behavior

D.Ramsey

Don’t go broke trying to look rich

The best investment you can make is in yourself

W. Buffet

The more you learn the more you earn

W. Buffet

You become what you believe O. Winfrey

O.Winfrey

It’s not your salary that makes you rich, it’s your spending habits

Being rich is having money. Being wealthy is having time.

Bullet Journal Vision Board

A vision board is a tool that enables you to visualize your short-term goals.

The most common misconception of using the visual board is thinking that putting an image with a fancy car or big house is enough to pursue your dreams.

Well, it’s not.

When it comes to creating a successful vision board, the crucial thing is how you want to achieve it, and not what you want to get.

Because you constantly see your goals in a visual way, you train your brain to create and notice the opportunities you need to reach them.

Bullet Journal Money Affirmations Page

Also, you can create a positive money mindset by using money affirmations.

Firstly, it may seem to be insignificant or even ridiculous to think that repeating mantras can lead you to have more money but trust me – it’s so worth putting them into a bullet journal and using them every single day.

Bullet Journal Gratitude Log

Surprisingly, spending only 5 minutes per day on daily gratitude practice in your bullet journal can be beneficial also for your bank account.

Moreover, it’s scientifically proved that being constantly grateful reduces stress, increases the level of happiness, and makes you care even less about material stuff.

Gratitude keeps you focused on what’s great in your life.

For that reason, you make better financial decisions and you live in the here and now.

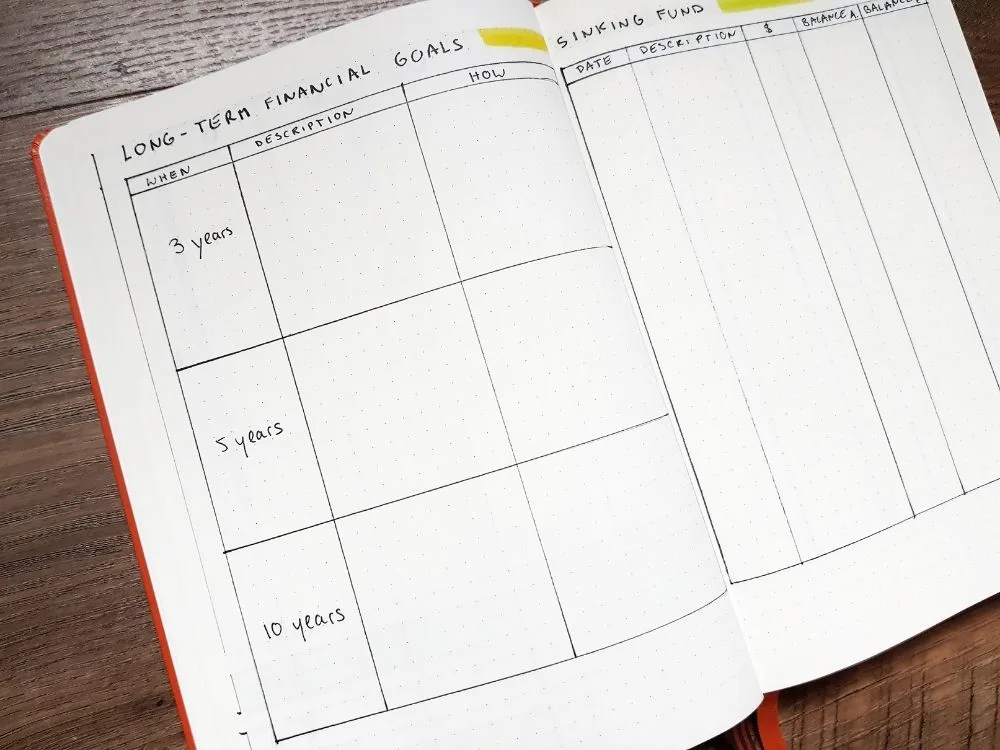

Bullet Journal Budget Layouts for Financial Goals

The next big step you need to accomplish is setting up your financial goals in a bullet journal.

First and foremost, your goals should be s.m.a.r.t. ( specific, measurable, achievable, relevant, and timed).

For instance, the “I want to be rich” goal isn’t s.m.a.r.t because it’s so generic.

On the other side, building a $1000 emergency fund by cutting off $100 monthly expenses on Uber from 01.01. To 30.10. is an example of a good financial goal.

Let’s take a closer look at this.

First of all, it’s a specific goal because you exactly know what you want to achieve (building an emergency fund).

Secondly, you can track the progress with an emergency fund tracker in your bullet journal (so it’s measurable).

Thirdly, you know that this goal is realistic because you’ve already found your spending leaks.

Next, you know why you want to achieve it (this will help you to cover unexpected expenses or a job loss and start feeling safer and calmer) and it becomes more relevant.

Last but not least, you know when you will reach this goal (31.10.) so it’s timed.

Bullet Journal Money Rules Spread

Along with your financial goals, you may want to create a money rules bullet journal spread.

Basically, you write the guideline down with the rules of what to do and what not to do.

Bullet Journal Finance Log

Now, when you’ve set your financial goals with a positive money mindset, the next step you should take is to create and follow a budget.

However, before you even start creating your bullet journal budget setup, the first thing you should find out is how much money you spend every month.

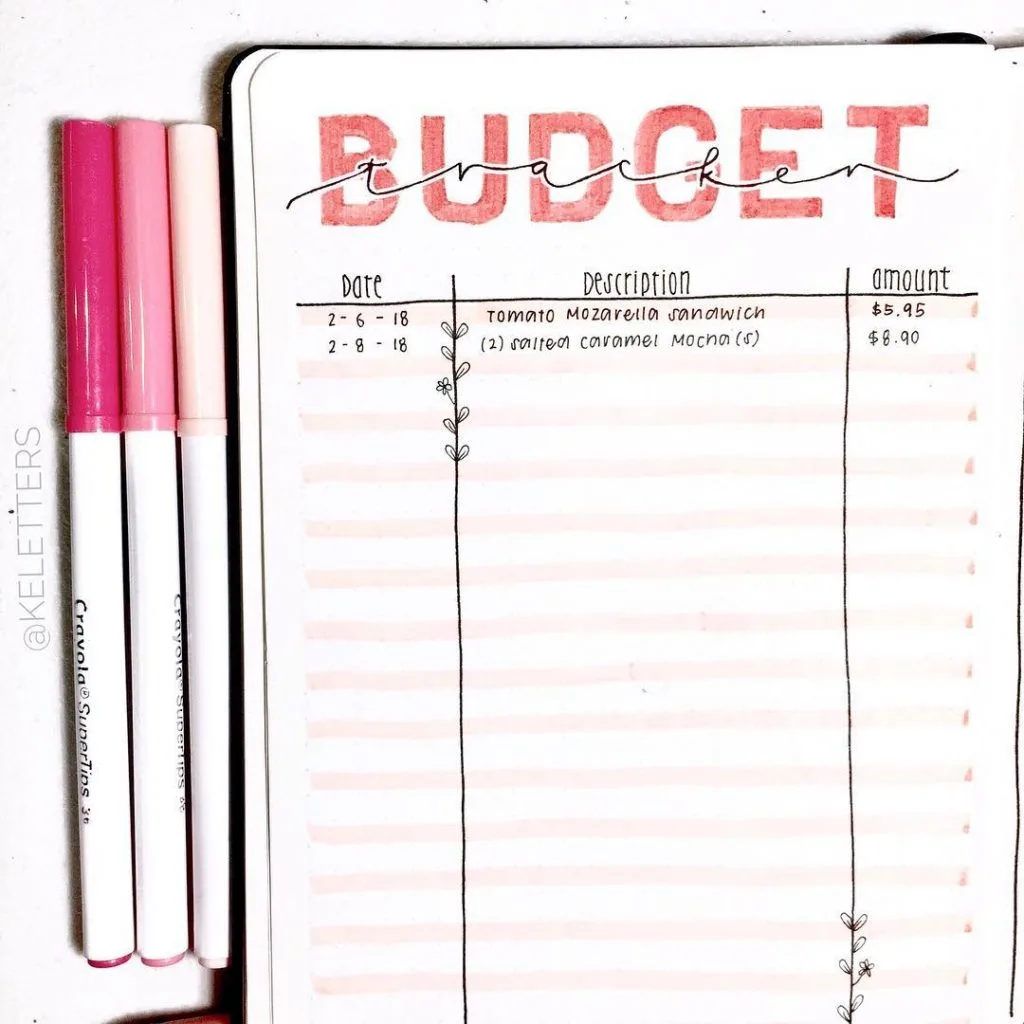

The easiest way to learn it is to create a spending journal within your bullet journal.

What is a Spending Journal

Basically, setting up a spending journal allows you to control any leak of money from your wallet.

If you’re wondering where your money goes every single day, creating a spending log in your bullet journal will help you keep an eye on every single dollar.

All you have to do is record your daily spending on a daily basis.

When you buy something, immediately write down the date, item, and how much it costs in a bullet journal spending log or keep receipts and do it within your evening routine.

It allows you to notice extra spending you’re most likely tend to forget about like coffee or magazines.

How to Budget with a Bullet Journal Budget Layouts

In most cases, it’s unbelievable how many excuses we can make in order not to do the budgeting.

One of my favorites is “I don’t know what tool I should use”.

First and foremost, you don’t need to get any fancy tools or apps.

A simple sheet of paper is absolutely ok.

Obviously, as a bullet journalist, you want to use your notebook.

If you’re wondering how to lay out a budget in a bullet journal, all you have to do is write down your income, savings, and expenses.

Budgeting Methods

Definitely, the most popular budgeting scenario is to allocate your savings only after you write down all income sources and monthly expenses.

And it’s ok, but it can lead to a situation where you don’t have any control of your monthly cash flow and you start to live beyond your means.

Basically, you don’t know where the money goes.

Obviously, it may happen that every month you have some leftovers to put on your savings account.

But more probably, you’ll spend them on stuff you don’t really need.

Consequently, without well-tailored money management, you might as well wake up with no assets and, what is worse, debts.

When I was doing some research on budgeting, I came across 5 methods that potentially can change your life forever:

- pay yourself first

- 50-30-20 budget

- Cash envelope

- Kakebo

- Ynab

Pay Yourself First

For that reason, my very first money rule for 2024 is to pay yourself first.

It means that before I start spending my money on anything (literally anything) else, I have to fill in my savings account right after receiving a salary.

Then I spend on housing, utilities, transportation, education, grocery, etc.

Not only you save much more money, but this will shift your mentality from being always in financial trouble to feeling safe and relaxed.

50-30-20 Budget Method

For the most part, managing your money can seem complicated.

By breaking it down into simple guidelines, you make your budgeting so much easier.

If you’re just starting out your journey, it may be a great option for you.

Just remember that it’s only a guideline and the split ratio depends on your income rate.

Basically, you split your income (after taxes) into a 50-30-20 ratio.

The 50 stands for 50% of your income that goes toward your needs like housing, food, utilities, etc.

30% of your income should be going towards your wants like clothing, eating out, fun activities, etc.

The rest is 20% you save or invest or pay debts off.

Cash Envelope Budgeting Method

In case you’ve never heard about the cash envelope system, it’s a budgeting method, where you determine your spending cash categories, stuff envelopes (one for each category) with a certain amount of cash, and track your spending.

In my opinion, managing so many envelopes can be a daunting task.

Luckily, I learned about the simplified version created by Jordan Page from Fun, cheap or free that works for cash and for cards as well.

Kakebo

- English (Publication Language)

- 192 Pages - 12/04/2018 (Publication Date) - Harper Paperbacks (Publisher)

Last update on 2024-12-03 / Affiliate links / Images from Amazon Product Advertising API

Recently, I found “Kakebo: The Japanese Art of Mindful Spending” notebook, where you can find not only information about kakebo and preformatted budget sheets for an entire year but also helpful tips on how to use it in order to track your spending and save money.

At first, kakebo translates as household accounts book and it’s a traditional budgeting method straight from Japan that will help you to:

- organize and control your daily expenses

- save more money

- stop buying the stuff you don’t need

- feel more secure

Firstly, you set up your monthly budget.

All you have to do is write down your income, fixed expenses, how much you want to save, and calculate how much money you have.

Secondly, you create a weekly expense log.

Similar to other budgeting methods, the first thing you should do is divide your expenses into four categories:

- essentials

- optional

- entertainment

- extras and unforeseen

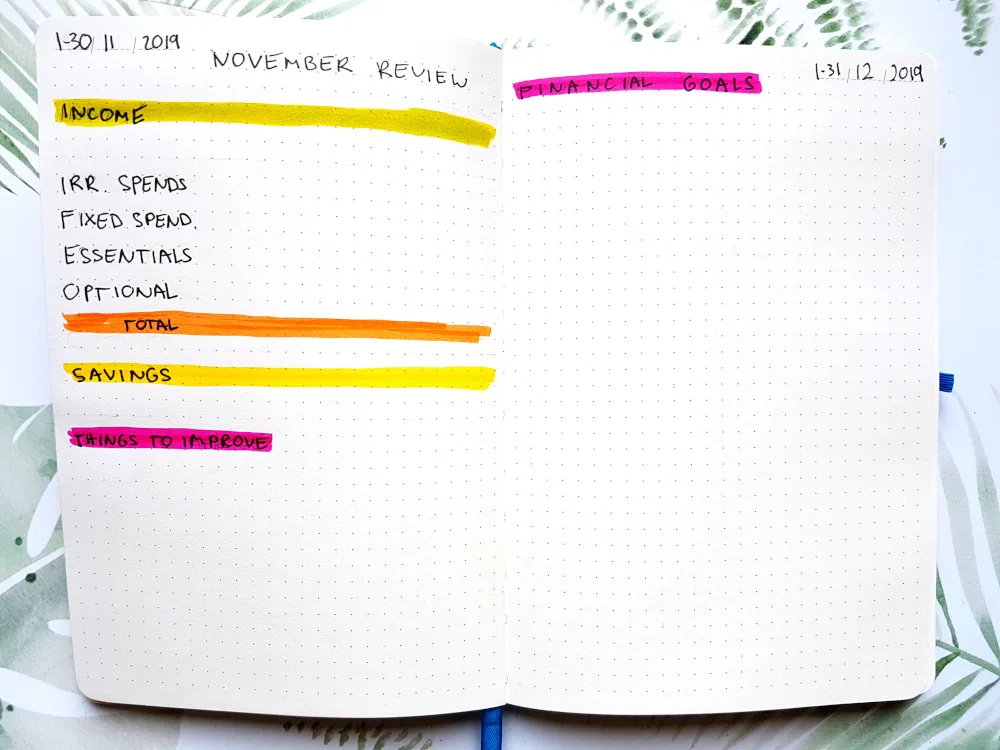

Last but not least, you create a summary of expenses at the end of the month.

It’s a bullet journal review page, where you can reflect on your spending habits or saving goals.

After a whole year, you create an annual review page, where you can sum up your yearly spending and set new financial goals for next year.

Obviously, you don’t have to get this book in order to use the kakebo method.

Your bullet journal notebook is enough.

YNAB

If you’re interested in personal finances, you probably hear about the YNAB (you need a budget) system.

It comes with a paid budget app and software where you manage your money.

Basically, the YNAB method is a zero-based budget system and it has 4 simple rules:

- use every single dollar with a purpose

- remember about variable expenses like car insurance or holidays and save for it monthly

- be flexible and keep your budget realistic

- after some time of constantly repeating the first three steps, start to pay all bills with your “old” money

Budgeting Bullet Journal Setup

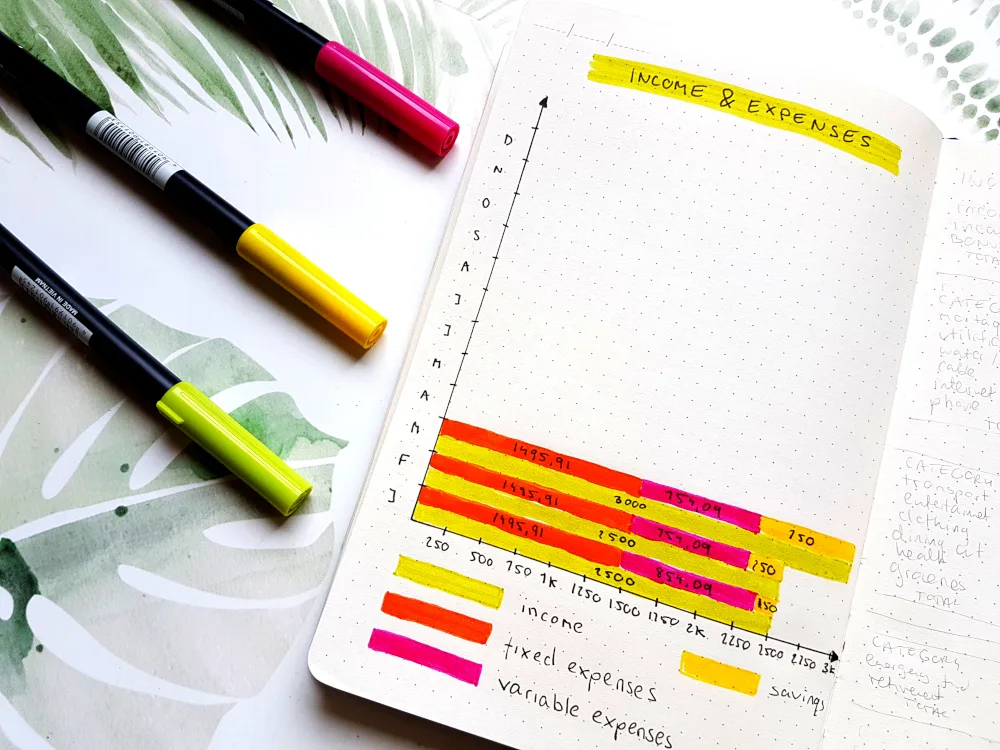

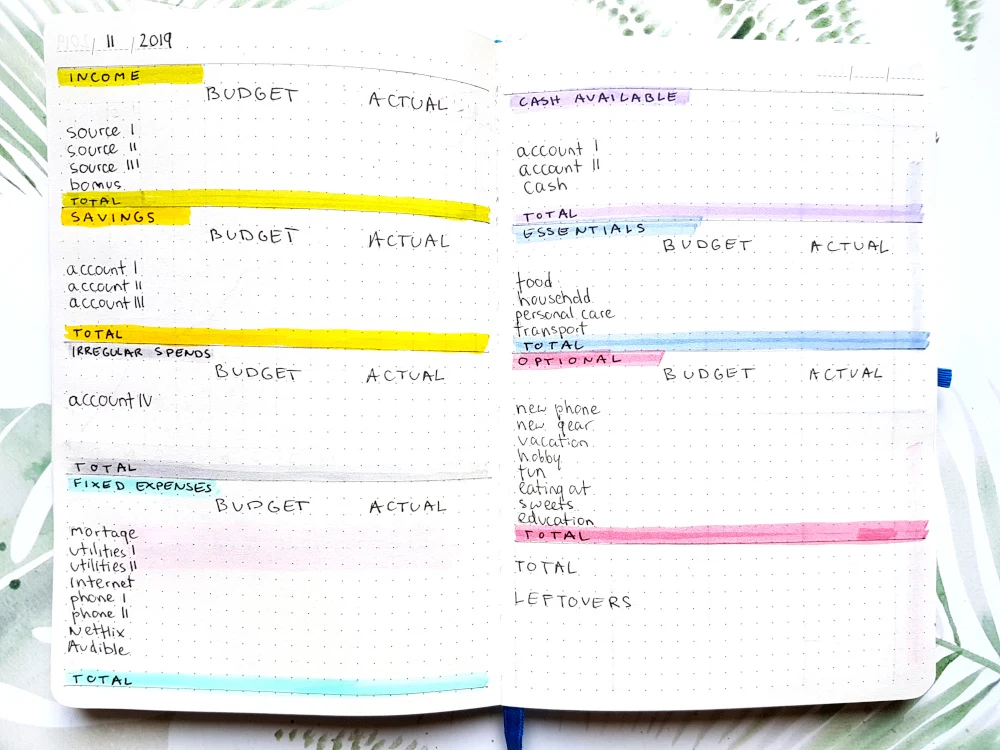

First and foremost, I set up my bullet journal budget layouts by mixing the budgeting methods mentioned above.

Firstly, I write down all my income sources (green).

Then, I calculate 20% savings for November due to 50-30-20 + pay yourself first method (yellow) and transfer the already budgeted amount for special occasions like Christmas or Halloween into an irregular spending account (grey).

Next, I put my fixed expenses (light blue) and determine a “kakebo” cash available (purple) by subtracting savings, irregular spending, and fixed expenses from the income.

Last but not least, I divide my available cash into two categories:

- essentials (food, household, personal care, and transportation)

and

- optional (savings for new gear, hobby, fun, education)

Also, I leave space for leftovers.

At the end of the month, if the amount is:

- positive, it means that I’ve saved even more money

- zero, it means that I’ve perfectly made my monthly budget

- negative, it means that I’ve spent more than I’ve planned

In addition, I highly recommend setting up a review page in your bujo.

It allows you to think about your spending habits, find any money leaks, and write down things to improve next month.

Other Bullet Journal Budget Layouts for Personal Finance

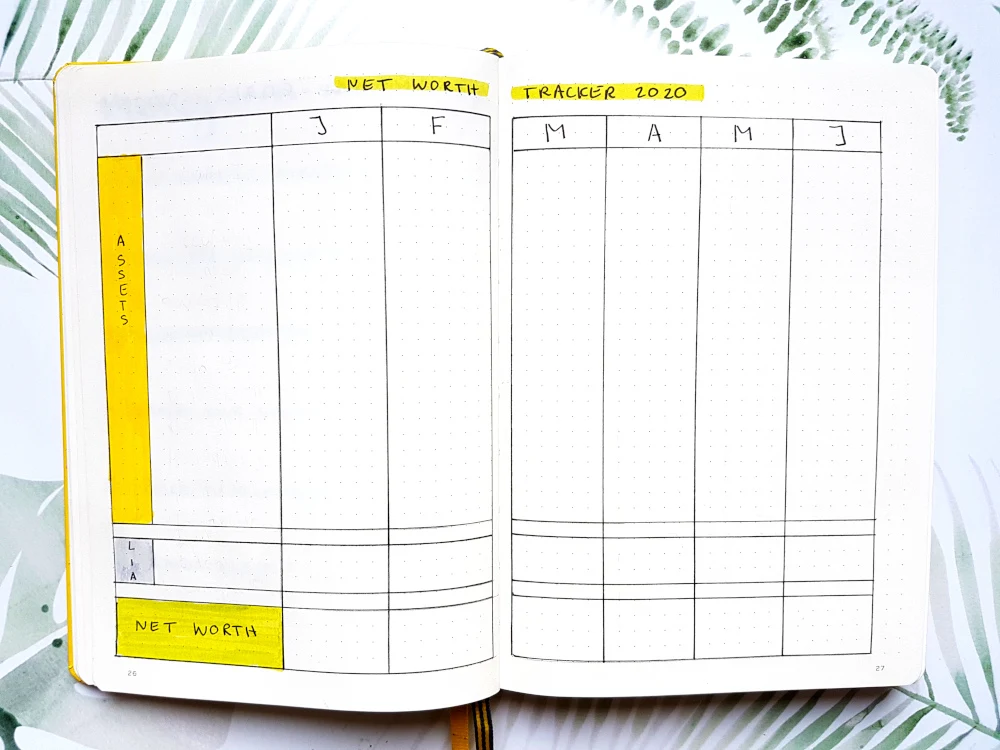

Bullet Journal Net Worth Tracker

Have you ever heard about retired former professional athletes, who have money troubles although they’re millionaires?

The painful truth is that you can earn hundreds of millions of dollars, and still be poor because your liabilities (everything you owe like a car loan or mortgage) exceed your assets (everything you own like saving accounts, retirement accounts, or maybe valuable Gucci bags collection).

For that reason, tracking your net worth is so crucial in order to control your financial health.

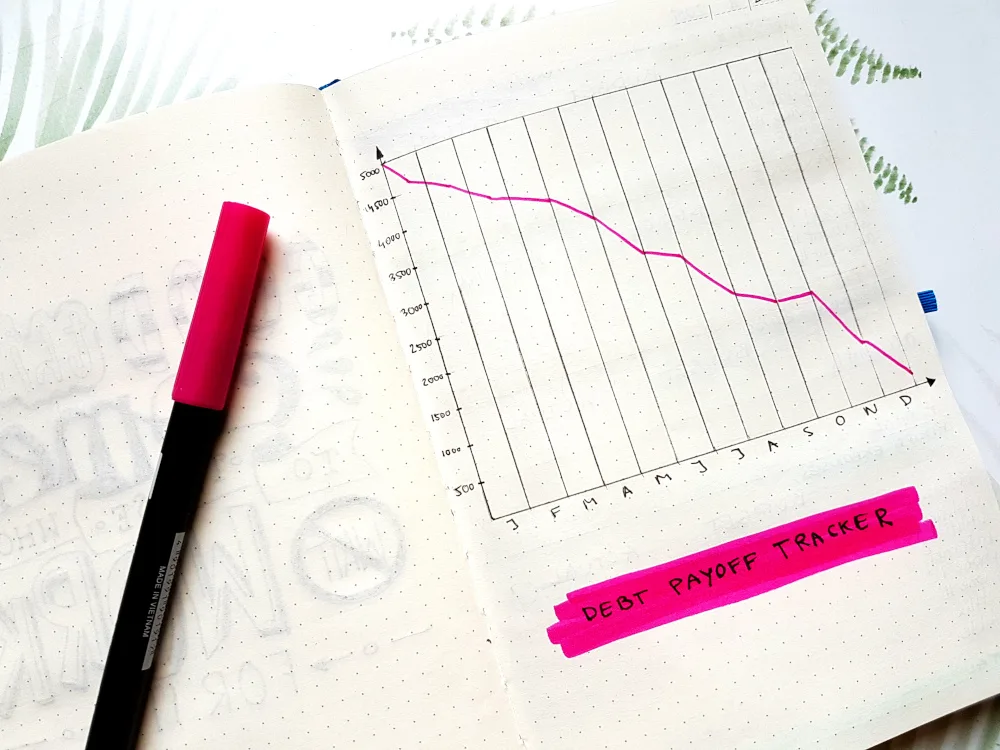

Bullet Journal Debt Payoff Tracker

The fastest way to pay off debt is to stop using debt, organize your finances with budgeting spreads, track your expenses and cut the unnecessary ones, create a debt payoff plan and track your progress, and make more money.

With this debt payoff chart, you can easily track your progress and stay motivated by seeing how the line goes down month after month.

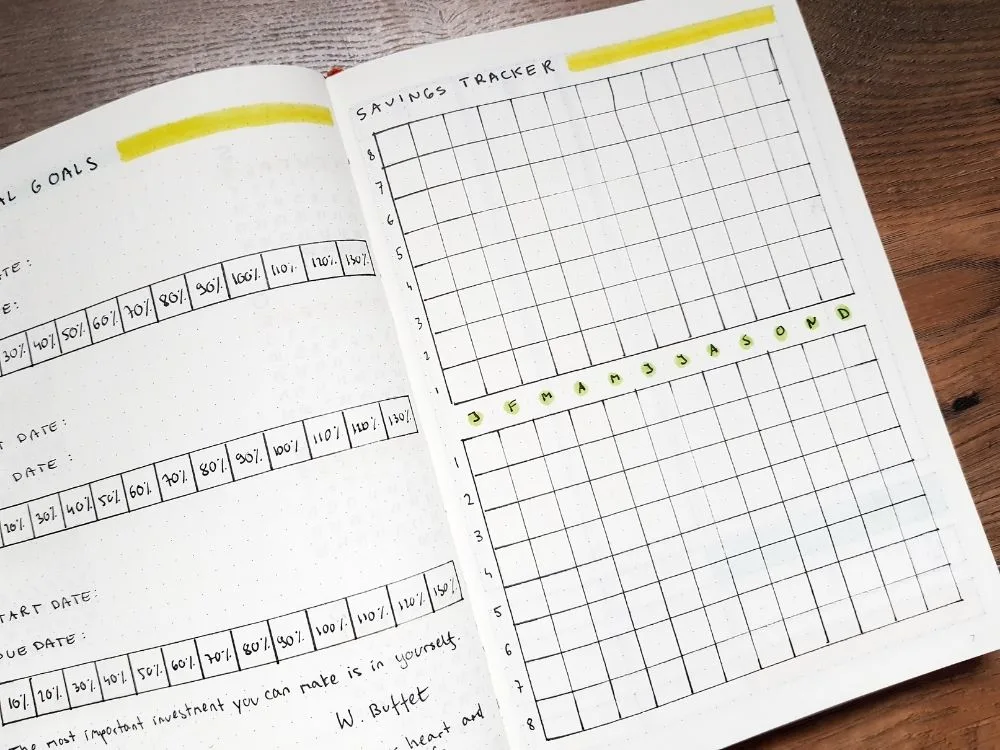

Bullet Journal Savings Tracker (Bullet Journal Budget Layouts)

Another important part of mastering personal finances is to start saving.

Although it may seem impossible especially when your income is pretty low, paying yourself first even 10%, and transferring it right after your paycheck into a savings account can really make a difference.

Also, the fun way to start saving is to participate in savings challenges like saving $ 10,000 in 52 weeks, and 30 days money challenge.

Besides, you can put no spend day challenge as a habit in a bullet journal habit tracker.

No matter what saving method you choose, definitely you want to track your progress.

Creating bullet journal spreads like a savings tracker (to build an emergency fund, to save for a house deposit, or for vacation) can help you stick with it and achieve your savings goals.

Bullet Journal Budget Layouts for Dave Ramsey’s Baby Steps

As I was scrolling down through Pinterest, looking for some inspiring budget journal ideas, I stumbled upon one constantly repeating name: Dave Ramsey.

The more I dived into Dave Ramsey’s tips, the more I wanted to give his Baby Steps a chance.

Baby Step 1 – $1000 Savings Goal

The first step (or, to be more precise, a baby step) is to set up an emergency fund you can use for unexpected accidents like medical visits, car repairs, etc.

I drew 20 rectangular – each of them equals $50.

Every time I save this amount, I’ll color one box.

The chart below will show how much money was saved during the month.

Baby Step 2 – The Debt Snowball

Before you start your debt snowball, you have to identify your debts – how much you owe and to whom.

Next, put all your debts in order – from the smallest to the largest.

You start paying off the smallest one (quick win – what a great motivation!) and then move on to the next one.

Baby Step 3 – 3 to 6 Month Fund

Another fund you should build is 3 to 6 months’ worth of expenses in case of losing a job.

Here I created another chart of how much money I deposit each month.

Baby Step 4 – Retirement

Baby step number 4 is to save some money for retirement.

Here Dave Ramsey recommends investing 15% of household income into a retirement fund.

In my layout, I’ll write down where and how much money I invested plus a short note if the investment is short- or long-term (according to the month).

Baby Step 5 – College Funding

Baby step number five is to save money for your children’s college education.

I created another chart that I’ll fill with my son’s age, value, and balance.

Baby Step 6 – Pay Off House

So you have all debts paid off, your savings are more than ok, and even your children don’t have to be worried about their education – it’s time to pay off your house earlier.

I’ll use the grid where every month I’ll add some amount, end balance, and extra money (fingers crossed for that).

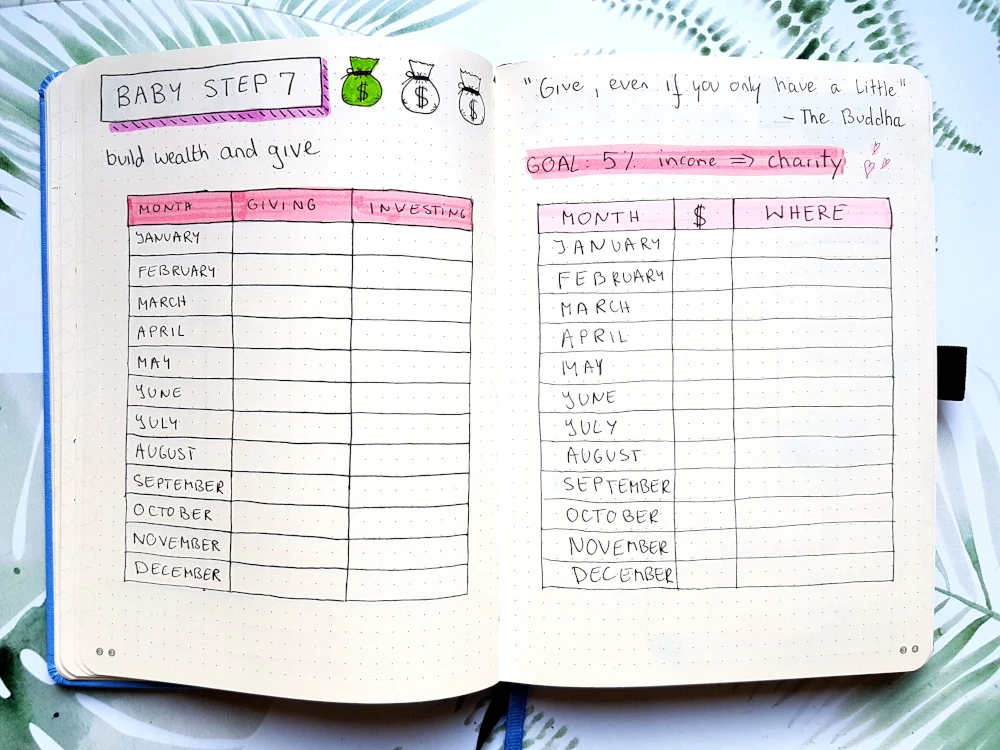

Baby Step 7 – Build Wealth & Give

It’s the last step.

Now you can get started on building wealth to create a better future for yourself.

It takes time to accomplish all 6 previous steps.

I’ve got a feeling that the last chart remains empty for a long time.

But “A journey of a thousand miles begins with a single step”.

Bullet Journal Budget Layouts – Final Thoughts

Without a doubt, creating bullet journal budget layouts is beneficial for your personal finances.

However, you should remember that a bullet journal is only a tool.

All hard work has to be done by you.

Bujo makes it only more entertaining.

Free Bullet Journal Budget Layouts Printables

By the way, if you don’t want to recreate your bullet journal budget spreads over and over again, below you can find free bullet journal budget printables aka printable financial tracker.

Generally, a spending plan is a place where you record income and expenses.

Similar to a daily journal, it’s your finance diary.

Basically, keeping a free money tracker spreads gives you control over your personal finances.

With this in mind, I designed free budget trackers and printable collections.

Undoubtedly, these budget tracker-free templates help you become more aware of your spending habits.

For instance, these free bullet journal budget trackers include the following layouts:

- finance tracker template

- money spending tracker printables

- bill tracker printable

- savings tracker

- credit card tracker

Finance Tracker Printable (Bullet Journal Budget Layouts)

Undoubtedly, budgeting is one of the most important things you can do for yourself.

Just imagine how your life would change if you had a healthy relationship with money.

Freedom, security, peace – you can finally have all these.

However, it takes time and the right tools to become debt-free and build your financial security.

But it’s so worth it.

With this in mind, the two first budget printable pages are monthly budget trackers.

Not only do you get a place to record your income, but you’re able to plan your monthly expenses ahead.

Indeed, tracking your budget is the best way to save money.

Finally, you can get on top of your finances.

In other words, you get rid of any anxiety about what’s going into your bank accounts.

To sum up, these free printable bill tracker templates contain a section for:

- housing

- transport

- personal expenses

- insurance

- loans

- entertainment

- food

- charity

Money Spending Tracker Templates (Bullet Journal Budget Layouts)

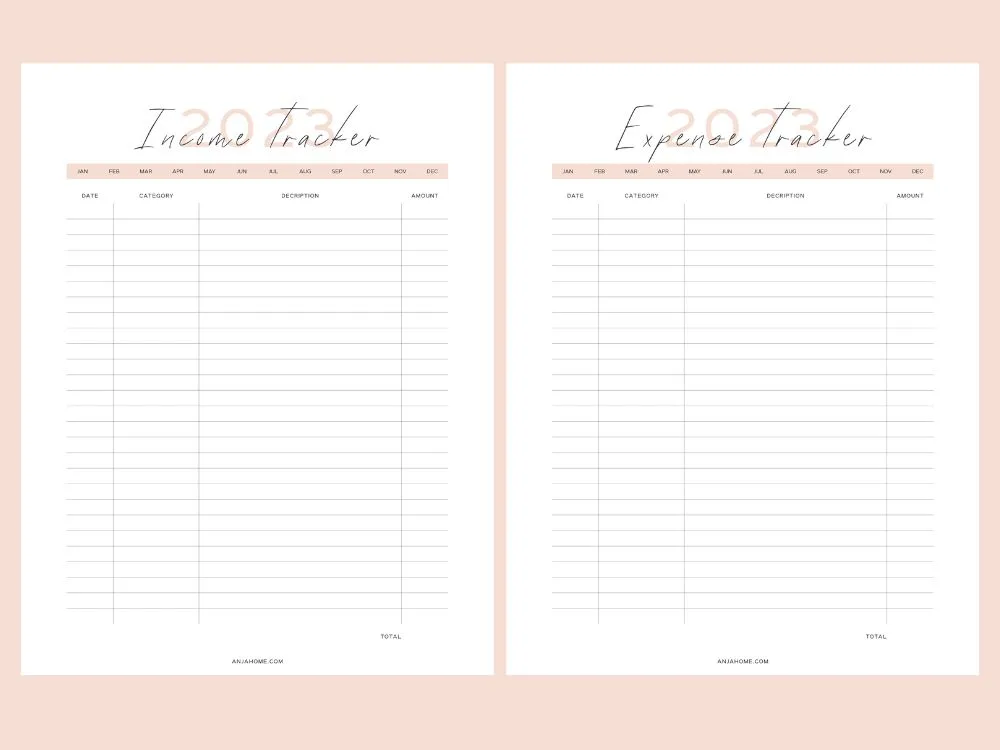

Firstly, there are two money spending tracker printables every budget planner should have.

Expense and income sheets.

Bullet Journal Expense Tracker Printable

Firstly, tracking your monthly expenses is the best way to see where your money goes.

Secondly, staying on a daily, weekly, and monthly budget is the only way to gain control over your money.

Because let’s face it – from time to time it feels like money disappears into thin air.

Undoubtedly, expense trackers allow you to track your spending.

As a result, you’ll be able to make smarter decisions about how you spend money.

Also, feel free to use this free bullet journal budget printable as a:

- daily spending tracker

- weekly expense tracker

- monthly expense tracking template

Bullet Journal Income Tracker

Along with a free expense tracker, you’ll get a bullet journal income tracker.

Undoubtedly, you’ll need this type of budget tracker if you have more than one source of income.

Indeed, it can be challenging to monitor how much cash is rolling into your pocket every month.

Additionally, income trackers may help you find more ways to increase your income by getting a side hustle.

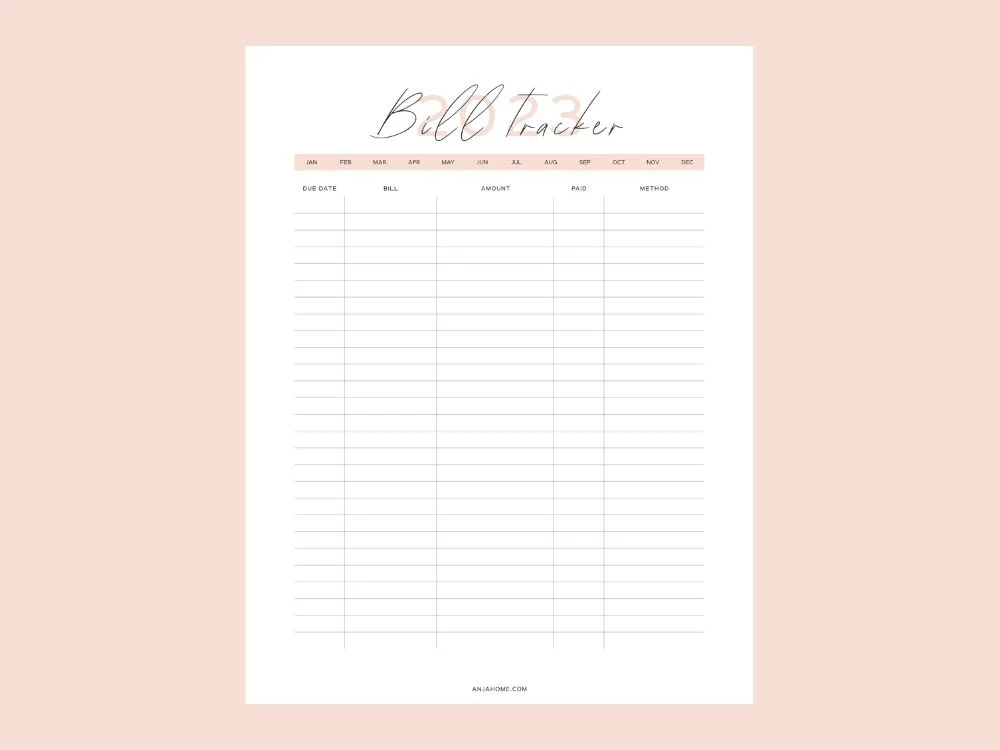

Bill Planner Printable

The next budget planner page is a monthly bill tracker.

Indeed, you need to pay your bills.

In other words, there’s no way to live in modern society without utility payments.

Therefore, a bill planner tracks all your fixed expenses.

Basically, you can easily see when your bills are due.

On top of that, a bill spreadsheet allows you to set up alerts.

As a result, you avoid any late fees.

To sum up, these free printable bill tracker templates let you sleep well at night knowing your bills are paid on time.

Printable Savings Tracker

After planning your monthly budget, paying bills on time, and tracking daily spending, it’s time to save money.

Definitely, saving money every month is your ticket to financial security and independence.

Designed for people of all ages, this free savings tracker lets you set up any goal.

For example, your first home or dream vacation.

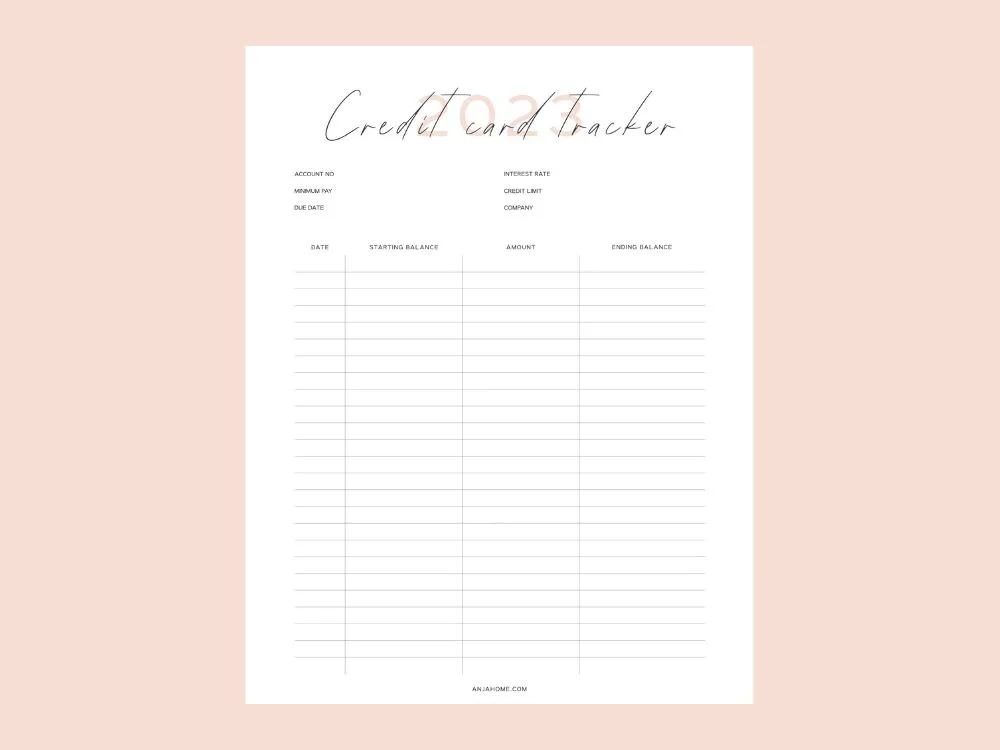

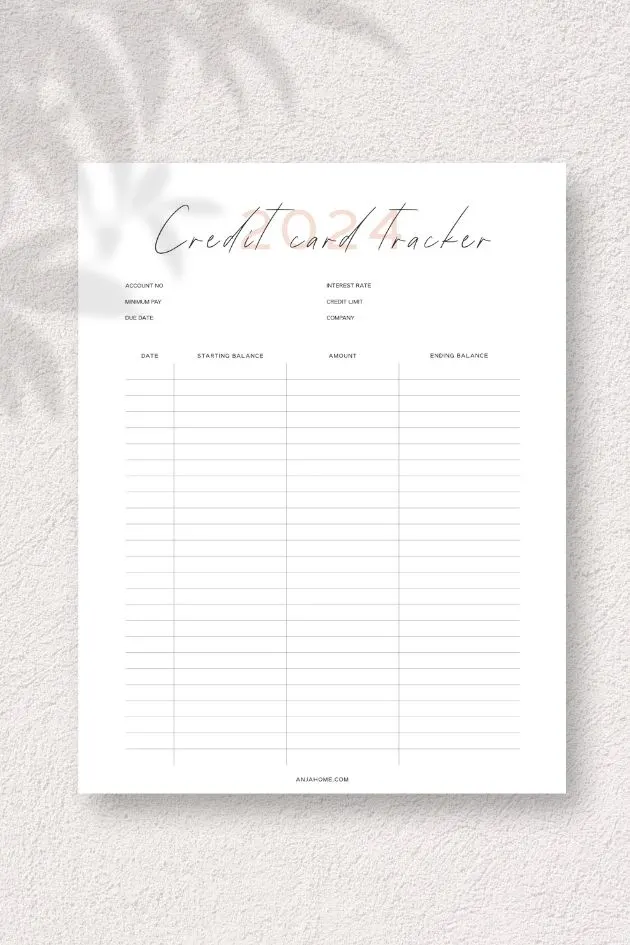

Printable Credit Card Tracker

Finally, there’s a free credit card tracker sheet template.

Undoubtedly, if you find yourself in debt, it’s important to track your debt’s payoff.

And credit card trackers allow you to set up goals to pay off all debts in full.

DOWNLOAD Free 2024 Budget Planner Printables

2024 Free Planner Printables

Free Printable Habit Tracker Templates

Free Fitness Journal Printables

Goal Setting Template Free Planner Printables

Printable College Student Planner

What’s Next? See How You Can Improve Your Life with Bullet Journal in 2024:

Bullet Journal Budget Layouts-FAQ

Do I Really Need a Bullet Journal Budgeting Spreads?

Undoubtedly a bullet journal method is a great idea to learn and maintain control of your money.

In other words, it’s a great way to take your financial planning to another level.

First and foremost, there are different ways to keep a track of your money.

According to your financial situation, bullet journal budget pages may help you achieve your financial long-term goals.

For example, if you want to pay your credit card debt or student loans, simply start using a debt tracker.

Or in case you don’t control your credit cards, just keep a credit card tracker.

To sum up, although there are lots of ways to work towards your budgeting goals, keeping bullet journal budgeting spreads is an effective way and creative way to stay on track.

How Do You Budget with a Bullet Journal Financial Spreads?

First and foremost, create a monthly bullet journal budget tracker that includes an income and expense tracker.

These monthly budget tracker pages allow you to track your spending on a monthly basis.

Alternatively, feel free to create a weekly spread instead of a monthly tracker – the time period is a personal choice.

The most important thing is to plan your monthly payments in a monthly spread and stick to a due date to avoid problems at the end of each month.

Also, the expense tracker bullet journal page is a good way to think twice before you purchase another gadget.

Indeed, financial trackers are a great thing when it comes to getting rid of bad spending habits.

Keeping a track of your progress is the most efficient way to learn how to work with priority-based budgets.

Also, I love to create a wish list.

Along with to-do lists, it’s my must-have bujo page.

Maybe it’s a better idea for your next page.

Do Budget Bullet Journal Pages Have to Be Aesthetic?

No, they don’t.

Although many bullet journal budget ideas feature a washi tape, beautiful letterings, and different colors, it’s totally up to you.

However, you may make your bullet journal budget spread prettier if you use a journal stencil planner set or you can use stickers.

Also, simply search for minimalist bullet journal ideas.

10 Creative Bullet Journal Budget Page Ideas to Save Money Today!

Saturday 20th of May 2023

[…] Bullet Journal Budget Layouts 2023 – AnjaHome […]

Bullet Journal Ideas (The big-ass list with over 1,000 resources for everyone from beginner to Instagram-famous expert.) | Your Visual Journal

Tuesday 9th of July 2019

[…] 20+ Bullet Journal Budget Layouts Only For People Who Suck With Money – Be sure to scroll the images on this one. There are some truly great layout ideas for finances from a number of different angles, including links to some printables from Anna at Anja Home. […]